Bull market is more dangerous than bear market!

Bull market is more dangerous than bear market!

I can emphatically tell you that bull market is more dangerous than bear market.

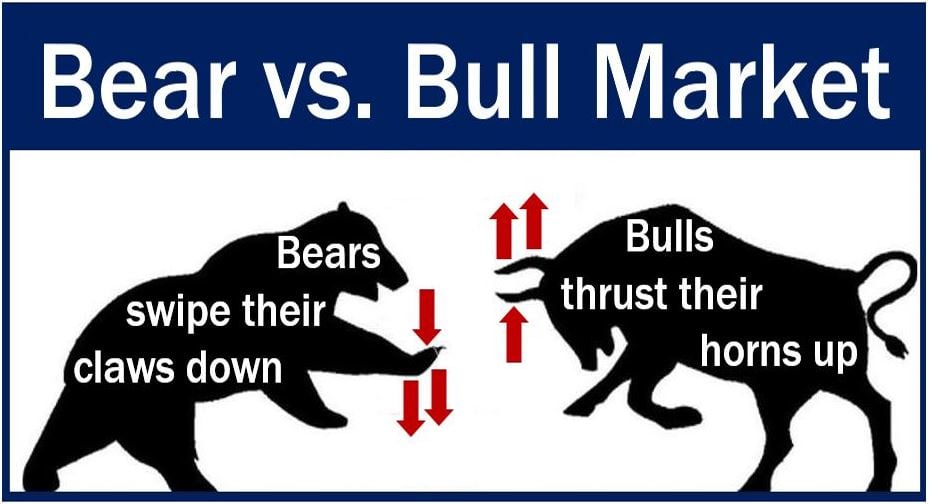

During a bear phase, the prices of stocks fall continuously and even the good news don’t have any impact on the equity prices leading to a downward trend.

Investors believe that this trend will continue, and it prolongs the downward spiral.

The opposite effect is felt during bull markets. In bull markets, there is a strong overall demand for stocks and the general tone of market commentary tends to be positive. Companies can get higher valuations for the equity, we tend to see high levels of IPO activity during bull markets.

Bad news don’t have any impact on the overall market trends and everyone looks genius.

Retail investors think that bull market is the best way to make money and they always welcome bull market.

But in reality you have to be very careful in the bull market especially during the prolonged bull markets.

The reason is every bull market is followed by bear market and that in turn is followed by another bull market.

The cycle continues like a sinusoidal wave. That means, any bull market is going to experience shockwave at the end of the cycle and opposite is true for a bear market. Bear market will pleasantly see a surprise at the peak of its cycle.

Take for example Adani enterprises. It went up on hyper drive from ₹120 to ₹4100+ from April 2020 to December 2022, and then it came tumbling down from the mountain to touch ₹1000 in less than 1 month. If you would have bought the media hyped stock at around ₹2000 in March 2022, you would’ve seen the stock doubling in less than 9 months. You would have also thought that you are a genius and lived in fool’s paradise. But when the bears knocked it down you would have realised the true picture of the story. Despite lots of influence, Adani group stocks fell crazy and surrounded all its gains in a jiffy. With just one example you may now agree to the fact that any bull market is dangerous to venture in. Whereas the peak of bear markets will not bother you much as the next cycle will help you to reap in the benefit.

For example RVNL was trading at ₹30 in August 2022 with no buyers but today when the bulls are sneaking in, it’s at ₹75+.

We had discussed at least half a dozen time in the recent past between 30+ to 60, but you would have neglected it thoroughly.The beauty of RVNL is that it can’t be pumped and dumped. On any given day it clocks a volume of at least 4-5 crore shares, and it’s market cap is 15k crore. It’s not a small cap stock and it’s not owned by any frauds. The company is owned by government entities. The bear market valuation is around ₹30+ and the value investor can never fail in any market environment. Remember it can’t be bought at any price. These two examples would give you a fair idea of why peak of the bear market is much safer than the peak of the bull market. As a contrarian we have to be more cautious in bull market as any slip will result in death traps. This only reminds me the King Humayun’s death. On the evening of 24th January , 1556, King Humayun was sitting on the roof of his library and was enjoying some music. Suddenly he got up to attend a meeting but miserably slipped from the stairs to die two days later.

If you fall from ground floor (akin to bear market) you will sustain injury but your life is endangered if you fall from 15th floor (akin to bull market).

Incidentally we wrote about RVNL on Monday and it went up by 10% ; the other two stocks - Wabag went up by miles but BoB didn’t make any move.

Never mind about BoB, but RVNL will move down after the ex-date of dividend and don’t be fooled by the up move in the month of April.

We just celebrated April fools day and media will always make you look like a fool on any given day.

It’s time you learn something everyday to stay away from the hyped news.

Let’s discuss more about the markets tomorrow and have a safe day in markets now.

Leave A Reply