How does power of compounding work in sip?

Today every financial mentor talks about early retirement. With the salaries touching the sky high even the younger ones who are in early 20s can plan for an early retirement. In the absence of a government pension and health care, creating a nest egg to fund their retirement life has now become more important than ever before.

Everyone must plan to retire early. Some lucky ones retire at the age of 40 or even earlier. In our last article we have discussed about the nest required to retire. If you haven’t read it, please click this link

https://finyugen.com/blogs/how-to-save-rs-7-crore-for-retirement-in-india-without-taking- risk

Also, Using the retirement calculator, you can easily set the goal.

https://finyugen.com/calculator.html

Having set the goal, we have to create a plan to achieve the goalpost. However, many individuals just look out for short cuts to achieve the goal. They look out for lotteries or Ponzi marketing schemes to make a big money. Unfortunately, we would fail miserably if we look out for any short cuts. The best way to achieve the goal is to set aside a small percentage of the salary towards retirement fund. Despite earning a big salary many individuals do not have saving habits owing to their high living standards. It’s hard to believe people who make lots of money remain poor, but many chartered accountants reveal that a large part of high income group people whose salaries are of 1 crore and above are living paycheque to paycheque. What makes getting rich so difficult is that spending less than you earn takes discipline.

On the other hand, I know many lowly paid Gen X made smart plans to achieve the goal. Generally, most teachers get a pittance for pay. Some smart school teachers have understood the magic formula of wealth creation and used it wisely to create a decent nest egg. Take for example, Andrew Hallam became a millionaire at the age of 36 and his nest egg grew more than he imagined that granted him financial freedom at the age of 40. His take home pay amounted to measly $28,000 a year but his family created 2.5 million US$ before he hung up his boots.

Andrew Hallam is not alone to achieve the goal. I know many unsung teachers who made into millionaires’ club by simply understanding the wealth creation formula. Albert Einstein famously stated: “Compound interest is the eighth wonder of the world. He, who understands it, earns it, he who doesn’t pays it.”

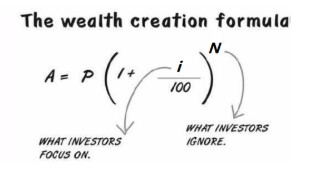

Now let us look at the formula more closely and learn our lessons.

You may wonder what is there to learn from this simple elementary school formula. In fact, I have learnt a behavioural science lesson from this equation. Sounds funny let us check it later.

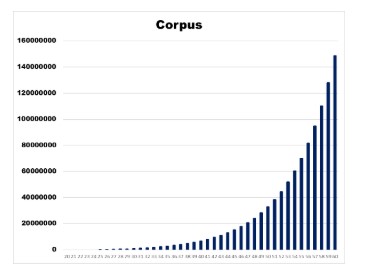

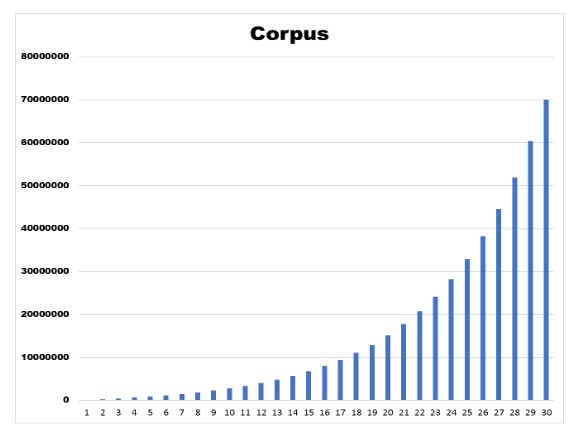

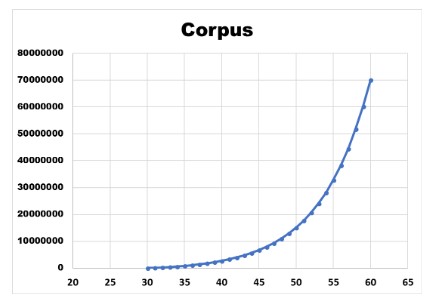

First and foremost, let us check the number of variables in the equation. You would quickly notice three variables on the right-hand side of the equation namely P, i and N. Here P is the sum invested N is the number of years and I is the interest. Generally, investors concentrate more on i, than on the P and N. Broadly speaking, we can control the amount we invest (P) and the number of years (N)we plan to lock in. In other words, the longer the investment horizon, the more the interest on interest earned and hence you have time working to your advantage. Once you understand this simple yet powerful formula you take advantage of it. A conservative return of 15% can make a monthly saving of 10000 into 7 crores in a matter of 30 years.

The same nest can be achieved in fewer years in case we increase our savings to Rs 15000.

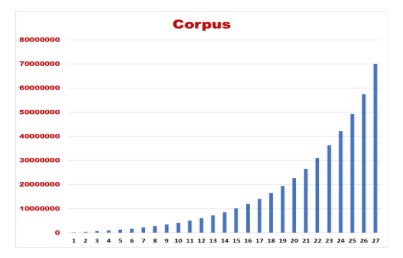

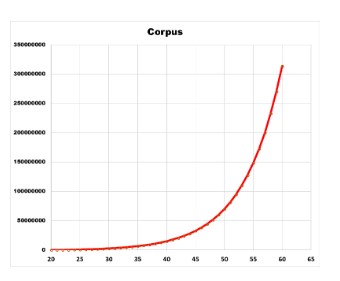

Likewise, an individual at an age of 20, start saving Rs 10 000 rupees per month at 15 per cent return and stays invested for 40 years, at the age 60, he will have over Rs 30 crore rupees.

However, starting the same journey just 5 years later will yield him/her Rs 15 crore

and starting 10 years later will yield only 7 crores. That is the cost you have to incur for the delay.

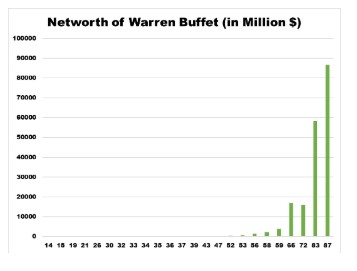

Let us check how Warren Buffet manipulated this equation to his advantage. The 85-year-old billionaire is one of the richest men in the world, with an estimated net worth of over $80 billion. In fact, many blogs claim that 99% of his wealth was earned after his 50th birthday.

But what they fail to understand is the power of compounding equation we discussed. The investing legend has been multiplying his wealth by a factor of 10 every decade. In fact, after 50 years of his age he compounded his money at slower rate. It appears that he made most of his money after 50 because of we are representing unequal numbers on the graph. Before we wrap up I would like to discuss about the behaviour lessons we can learn from this formula. If we rewrite the equation using simple behavioural science logic., the nest egg will be higher if we cultivate patience (N) and control our spending behaviour which would directly result in more savings (which leaves us more P). Please note that out of the three variables 2 are easily controllable by us and hence we have to concentrate on them than on the third variable which is market driven.

You may now think that it is not a herculean job to create such a big nest if we plan well in advance. The key is to start early and understand the wealth creation formula. We know that little drops of water make a mighty ocean. If we systematically plan our savings, the task becomes very simple.

Leave A Reply