Secrets of MediumTerm Investing

In our last article, we have mastered a technique to make short term profits through stocks. In this article, we will learn a technique to make money through stocks in the medium term.

When we say medium term, the holding period is quite longer- it is 3-5 years. Similar to our last lesson, here also we are going to buy the leader but the idea is slightly different. In this case we are going to scan the stocks using fundamental analysis as our holding period is longer.

The key to passive investing is to buy the stock based on its earnings growth. The growth must not only be consistent in the last few years but also should have outperformed its peers in all other fundamental indicators. To understand better let us take up with an example.

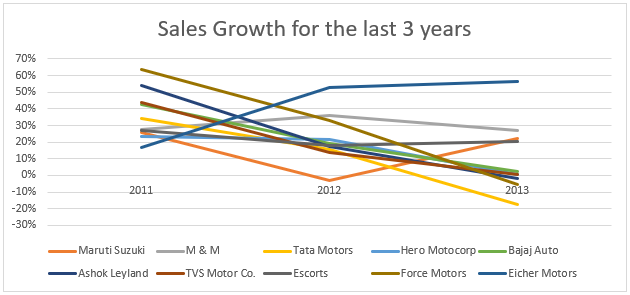

Let us go back to year 2014, when the consumer confidence started to improve. The effect of which is clearly seen in automobile as its starts to post higher sales. Once you pick up the sector we have to find which stock posts consistent sales growth in the last 3 years. Let us check it out.

From the above chart, it is evident that Eicher Motors has grown consistently in the past three ye

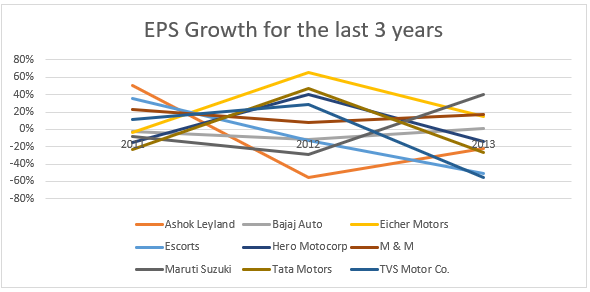

sed growth by decreasing the price. In other words, we will have to check if the company has the pricing power. First step is to check the profitability metric by comparing the EPS growth of the companies in the last 3 years.

It is clear that Eicher motors has emerged as the leader in recording the EPS growth in the selected period.

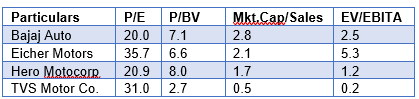

Now we have to check if Mr. Market offers right kind of valuation to buy the stock.

We are confining to the two-wheeler industry as Eicher sells motor cycles. It is not appropriate to compare it with other automobile companies namely Maruti which sells cars. We have presented the valuation metrics such as price-earnings (P/E), Market Cap-to-sales (P/S) and Enterprise value / EBITDA (EV/EBITDA) in the following table.

It is evident that Eicher Motors is valued at significantly higher multiples than the rest of the group in all four measures of valuation. It’s pricy because of the leadership position and the investor confidence is reflected in the price. Sometimes, the leaders command better multiples and we are accepting it as it has been posting a sales growth of nearly 60%, besides the premium is not heavy.

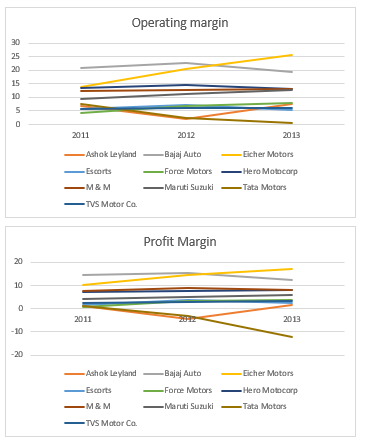

Let us go to the next checking and use some more fundamental metrics like Operating margin, profit margin, Debt/equity ratio, Return on Equity (ROE) and return on assets (ROA).

First we will start analysing the profitability metrics i.e Operating Margin and Profit Margin by comparing the data of the companies for the last three years

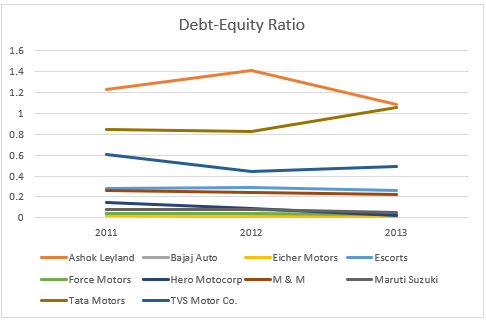

In both the charts, you could see that Eicher Motors is faring much better than others. This is a positive sign for the stock. The company may improve the margins by using debts and hence it is necessary to compare the Debt Equity ratio with those of its peers. Here is the chart.

Eicher piped its peers and came out on the top even in debt-equity ratio. In the first 2 years it had negligible debt while it retired all its debts recently and became a zero debt company which is a rare feat in the auto company.

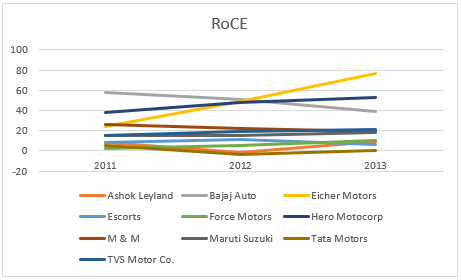

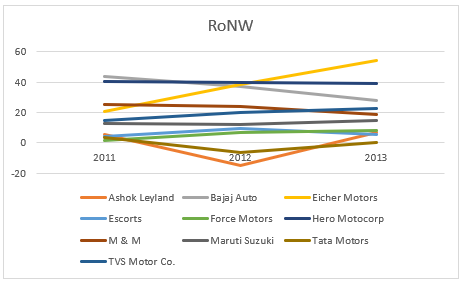

Finally we will check the ability of the company to generate returns from its available capital base with two more indices namely Return on Capital Employed (RoCE) and (RoNW)

Once again, Eicher Motors has an uncanny ability to emerge as a leader in this test too.

Hence, we could have selected Eicher Motors in the year 2014 for medium term investing as it has emerged as winner in all the fundamental parameters. Yes, it’s valuation matrix may a bit of a worry but a leader of any sector would always command better valuations and hence we are going ahead with the selection.

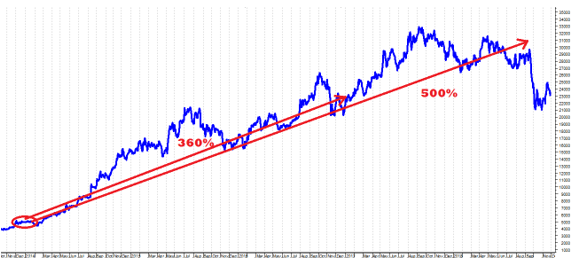

Assuming that you have bought the stock at the end of January 2014 when it was trading around Rs.5000, let us check how it fared in the next few years.

Had you invested and waited patiently for 3 years, it would have given you a massive return of 360%. The same investment would have would have fetched a return of 500% in 5 years. In other words, had you locked Rs. 10 Lakhs in Eicher in January 2014, it would have become Rs. 60 Lakhs in the year 2018. That is the secret of passive investing

Leave A Reply