Secrets of Short Term Investing in Stocks

In the next three articles, we are going to teach you some techniques to profit from stock market.

We all know that investors have made tons of money in stocks without much capital. Ace investor Rakesh Jhunjhunwala made billions with an initial capital of Rs 5000 and Warren Buffett made several billions with a small capital of $1000. Making big money to achieve the financial freedom is the key to investing. However, each one of us have short, medium and long-term goals and the objective of the next three articles is to learn the strategies to achieve them using stock market.

If the investor desires to buy a car in the short term, he/she may require anywhere between Rs 3-5 lakhs. The medium term the goal may be to send the son/daughter for higher studies for which a sizable sum of Rs 50-75 lakhs is required. In the long term the investor may have set a goal to buy a cosy house which could cost anywhere between 1-3 crore. Having set the Short Term / Medium term / Long Term let us find the methodology to achieve them. Though there are plenty of ways to achieve the same we have presented here a simplistic approach

In this article we will see the how to make money through stocks in a short term.

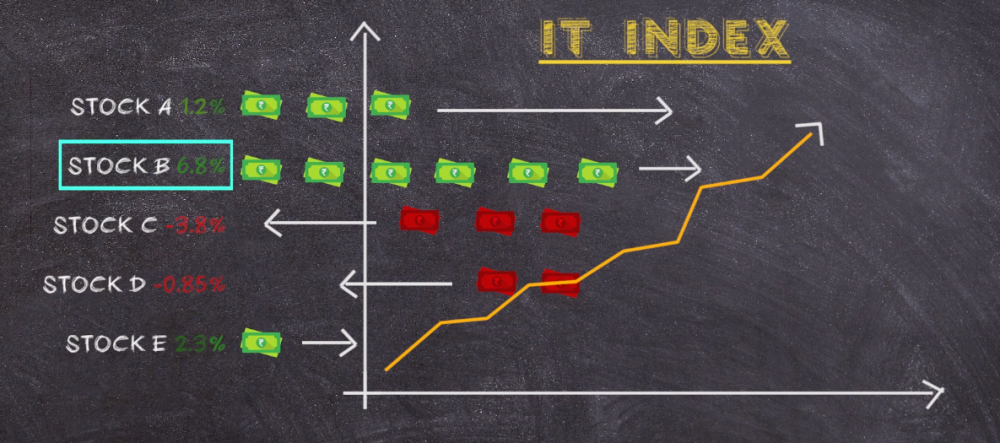

For achieving the short-term goals, we have to buy the leader of the trending sector.

If IT sector is helping the index to post gains then we have to find the stock within the IT sector which is posting more gains than others. That is the leader of the sector.

Once we identify the leader our job becomes simple. We have to buy and hold the identified stock till the trend ends. Trend trading is probably one of the easiest types of trading to understand. However, Short term trading is one of the most difficult aspects of investing and one requires to master the skills to make money. To understand better, we are explaining the same with the help of an example:

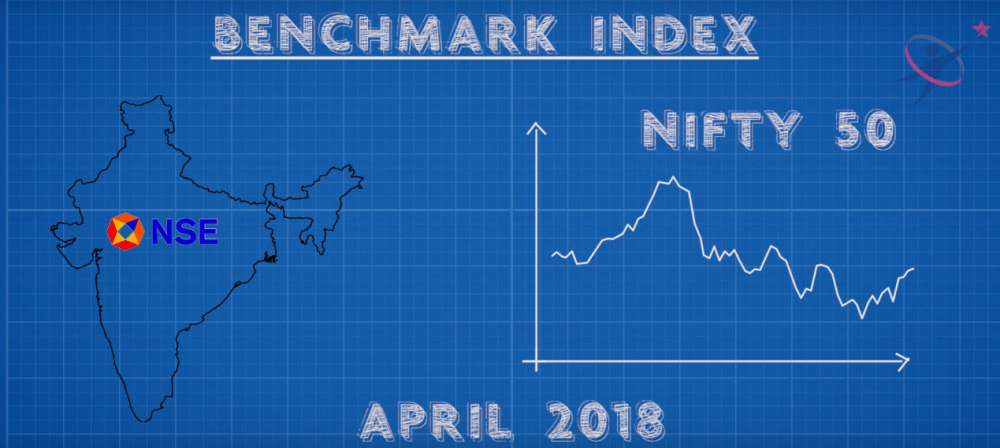

Let us take the chart of Benchmark Index, in the case of India NIFTY 50 is a bench mark index. Let us take the index of April 2018.

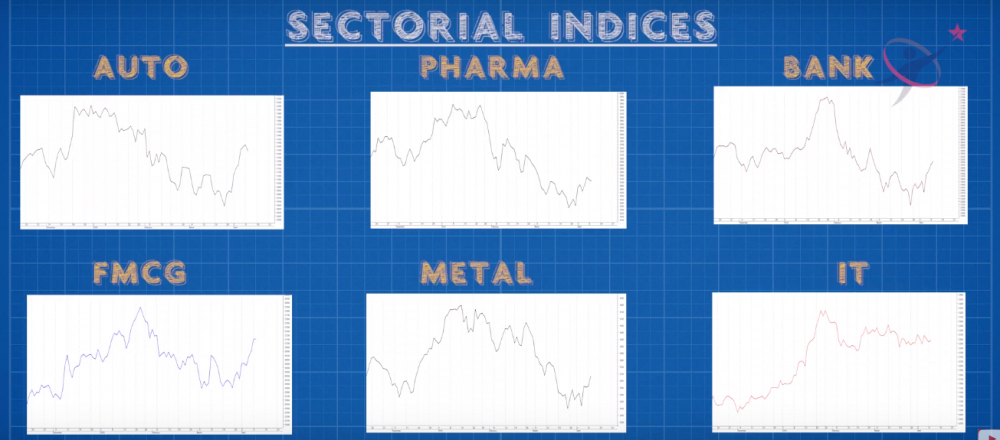

Similarly, there are Indices available for each and every sector.

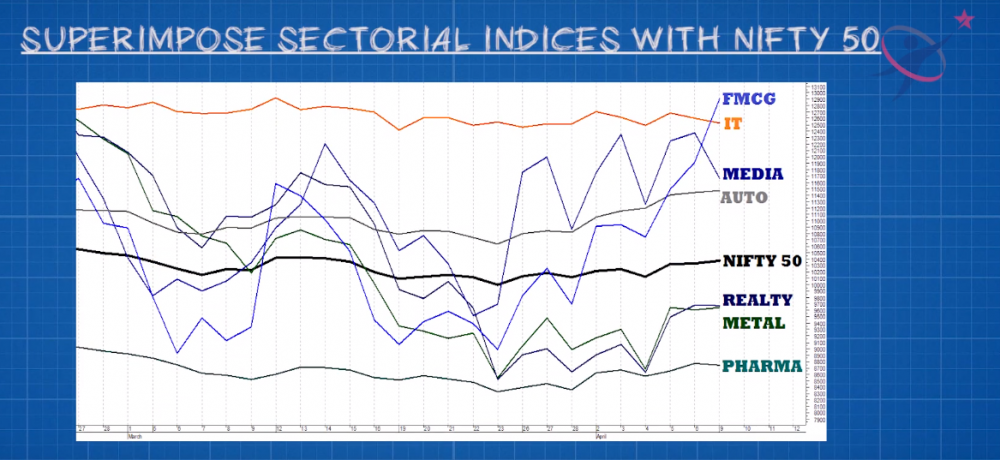

We have to superimpose the sectorial indices on the NIFTY 50 chart.

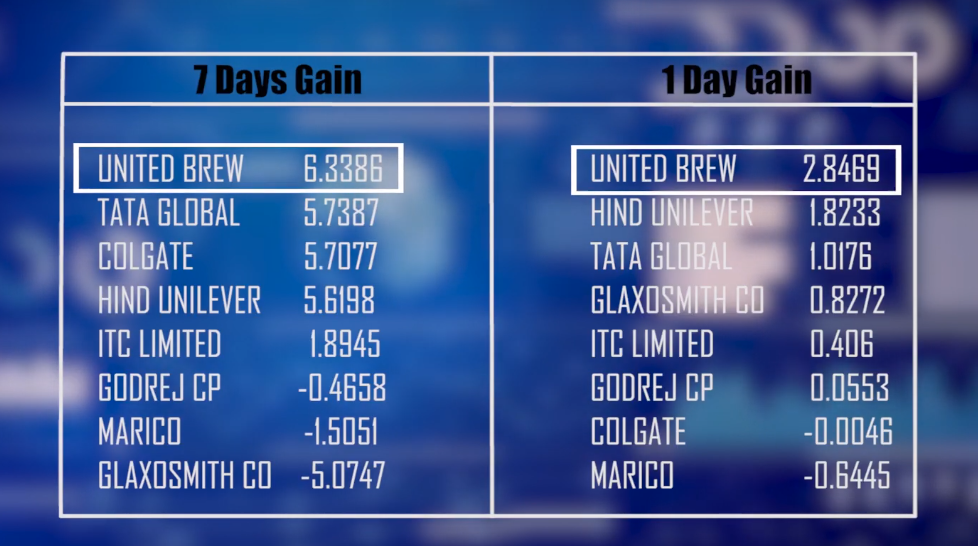

From the chart, you would be able to see which sector has outperformed with respect to the Benchmark Index. Yes, you are right. You could very well FMCG outperformed the rest of its peers. Once you select the sector, the very next step is to to find the leader in that sector. Now we have to find the most gained stock within the sector in other words, the leader of the sector. Let us scan them and present you the results.

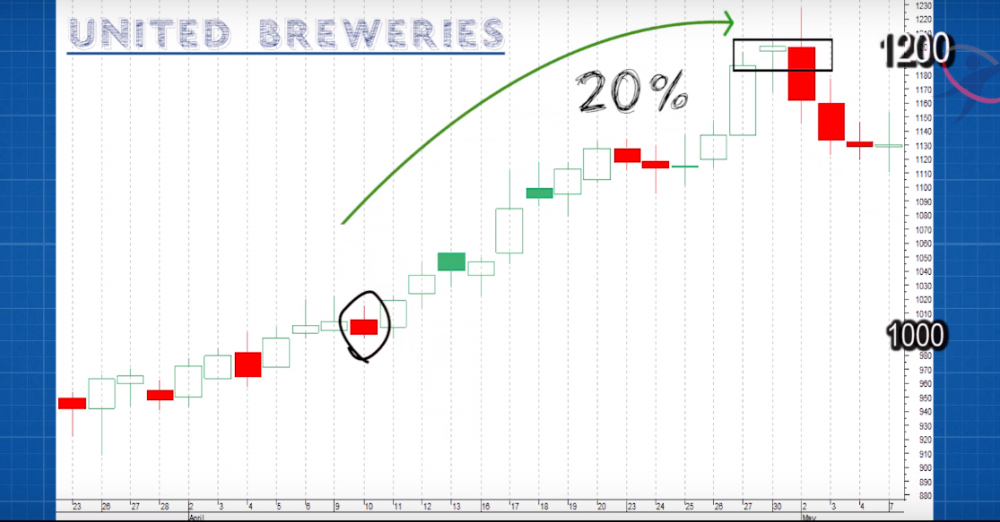

You would have surely picked United breweries. Assuming that you have bought it on 10th April when it was trading around Rs 1000 the stock gathered momentum and posted 20% gains in less 1 month.

It looks fantastic right? However, you should know when to exit it. The key to exit is when the trend reversal takes place or when it underperforms the benchmark Index. Here in this case the stock started to reverse after touching Rs 1200 which is evident from the Chart.

You might have not missed out to take out your profits from the stock. Yes, you need some practice to do it better but today you have successfully learned a good strategy to make short term profits. We will continue to present some more techniques in our later articles.

Leave A Reply