POPULAR POSTS

Correction is good provided you use them wisely!

As expected by us the market experienced a sharp sell off. Most Investors were flabbergasted by the correction as they expected the market to move up. Yesterday, all sectors closed in red and it’s a good sign for the markets. Let’s enjoy the crash as it will bring back sanity into the markets.

READ MORE

Indian market is in strong bullish mode !

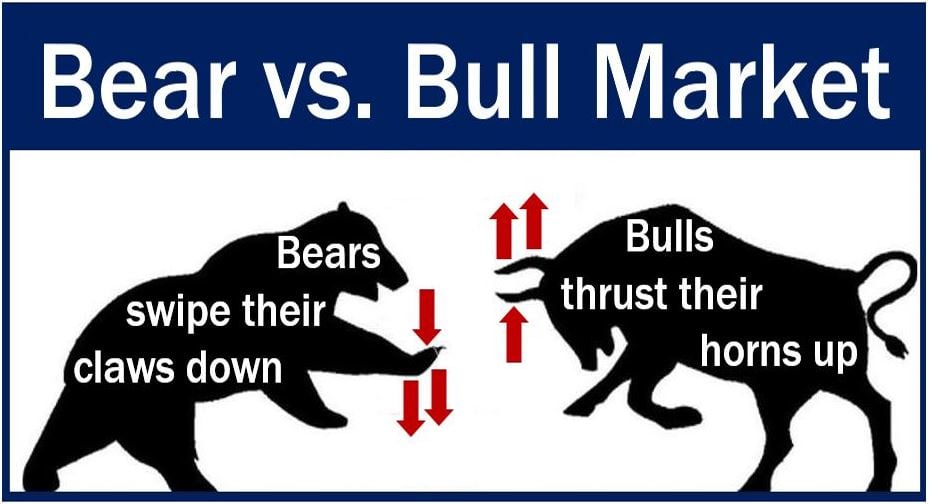

Fake analysts may say the market goes up when there are more buyers than sellers and it goes down when there are more sellers than buyers. What matters more is the sentiment. It’s always a sentiment driven market. For example, way back in 2000 leadership stock like Infosys went down from 18000 to 2500 without trading a single stock. Even during 2020 many stock went down from filter to filter without much selling.

READ MORE

Resilient Indian Economy to help you make wealth?

As far as Indian markets are concerned, corporate results are showing mixed trends. The analysts estimates have gone wayward. No one is sure as to where commodities, interest rate and economic scenario are headed in the short-to-medium term. It’s better to buy stocks which are offering value rather than to pick momentum. One good thing is the CPI inflation rose just 4.7% in May 2023, marking the weakest reading in 18 months. The WPI fell to a near three-year low of 0.92 in April, slipping into negative territory for the first time in 33 months. These indicators are good for the economy.

READ MORE

Are you learning to win the game ?

Winning the market requires entirely a different set of skill set. In the world of distraction, undoubtedly emotional control is one of the key factor to create massive wealth. Distraction caused by Media, YouTube, smartphones, social media, business news, stock prices etc is too difficult to avoid in this creepy world.

READ MORE

Are you tracking growth or Media noise about economy, Recession and elections etc ?

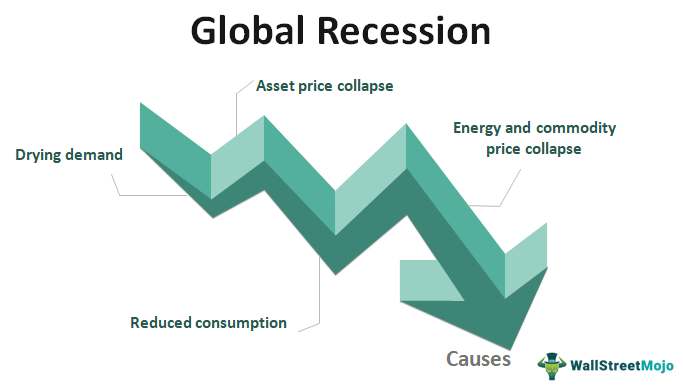

Yesterday we discussed about US and Indian stocks in a zoom meeting. One of our senior member in the group asked when US is in recession how can India grow especially during the election year?. Remember most US companies (exceptions are there) are struggling to post good results, where as very many India companies are posting great results.

READ MORE

Is recession coming for the US?

A new Bloomberg survey puts the probability of a downturn in the next year at 65%, up from 60% in February. Whether it’s recession or not it’s better to buy GARP stocks. Investors always buy app based stocks or the ones that are discussed in the media. One such example is Vedanta.

READ MORE

Are you going after the Buzzword in market?

What’s the buzzword now in the market? In 2020 the buzzword was crypto currency. Bitcoin witness a mad rush and it went up from $7000 in 2020 to 63000+ in 2021. All happened in a matter of 10-12 months, and when the rally fizzled out, it nosedived again to $15000. Today the buzzword is AI. The market is energised by the magical word AI and any company that uses AI as a catchphrase goes up like a rocket.

READ MORE

Bull market is more dangerous than bear market!

During a bear phase, the prices of stocks fall continuously and even the good news don’t have any impact on the equity prices leading to a downward trend. The opposite effect is felt during bull markets. In bull markets, there is a strong overall demand for stocks and the general tone of market commentary tends to be positive. Companies can get higher valuations for the equity, we tend to see high levels of IPO activity during bull markets.

READ MORE

3 Interesting stocks for this April

We can always trade in ETF to pay less. There is no STT charged for Liquid BeES/Liquid ETFs, GOLD ETF and some international ETF. Yet investors don’t use it to their advantage. In fact you don’t need a lot of knowledge to invest and profit from gold ETF. Time to time we also discuss about Gold yet none take advantage of the opportunity. Maybe I should stop discussing about it from now onwards.

READ MORE

Get ready for the changing world?

The world is changing rapidly around us. Faster than most people can think of. Market responds to the real life situation.

READ MORE